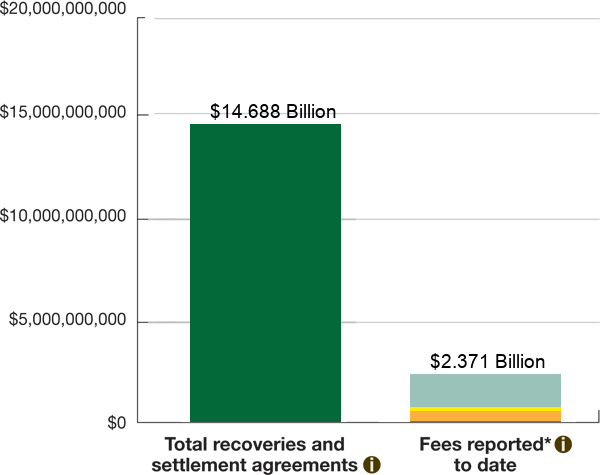

As of February 28, 2025, the Securities Investor Protection Act (SIPA) Trustee has recovered or reached agreements to recover approximately $14.739 billion. This recovery far exceeds any prior restitution efforts related to Ponzi schemes both in terms of dollars and percentage of stolen funds recovered.

One hundred percent of the SIPA Trustee's recoveries will be allocated to the BLMIS Customer Fund for distribution to BLMIS customers with allowed claims. The costs associated with the SIPA Trustee’s recovery and settlement efforts are paid by administrative advances from the Securities Investor Protection Corporation (SIPC), which administers a fund drawn upon assessments on the securities industry. No fees or other costs of administration are paid from recoveries obtained by the SIPA Trustee for the benefit of BLMIS customers with allowed claims.

No administration costs, including the compensation of the SIPA Trustee and his counsel, are paid out of any recoveries obtained by the Trustee for the Customer Fund. 100 percent of the Customer Fund is for the benefit of BLMIS customers with allowed claims. Fees shown include all fees reported from the commencement of the liquidation on December 15, 2008, through September 30, 2024.

FEES

The fees of the Securities Investor Protection Act (SIPA) Trustee and his BakerHostetler counsel are paid by Securities Investor Protection Corporation (SIPC); no fees are paid from recoveries obtained by the SIPA Trustee for the benefit of Bernard L. Madoff Investment Securities LLC (BLMIS) customers with allowed claims. Detailed fee applications, filed at regular intervals with the United States Bankruptcy Court for the Southern District of New York, outline the work performed on the SIPA liquidation of BLMIS in the select period. The fee applications detail legal and professional services rendered, the status of the liquidation and distributions to date, while showing the discounts applied, including the 10 percent public interest discount, which the SIPA Trustee and BakerHostetler have adopted since the beginning of the BLMIS liquidation. The SIPA Trustee and BakerHostetler’s fees are regularly presented to the Bankruptcy Court for review and approval. Fees shown include all fees reported from the commencement of the liquidation, December 15, 2008, through September 30, 2024.

$1.663 Billion

No administration costs, including the compensation of the SIPA Trustee and his counsel, are paid out of any recoveries obtained by the Trustee for the Customer Fund. 100 percent of the Customer Fund is for the benefit of BLMIS customers with allowed claims. Fees shown include all fees reported from the commencement of the liquidation, December 15, 2008, through September 30, 2024.

$218.2 Million

Consultants and Other Professionals fees on this chart include special consultants, mediators, and others. Other Professional fees are paid by administrative advances from SIPC; none of these fees are paid from recoveries obtained for the benefit of BLMIS customers with allowed claims. Fees shown are those reported from the commencement of the liquidation, December 15, 2008, through September 30, 2024.

$511.2 Million

General Administrative expenses include the costs related to the investigation and foreign research, technology, rent – including office, equipment and warehouse – telephones and telegraph, utilities, taxes, escrow costs, employee-related costs, and claims-related costs such as mailings, court-related noticing and insurance. General administrative expenses are paid by the Securities Investor Protection Corporation (SIPC); no fees are paid from recoveries obtained by the Securities Investor Protection Act (SIPA) Trustee for the benefit of Bernard L. Madoff Investment Securities LLC (BLMIS) customers with allowed claims. Fees shown are those reported from the commencement of the liquidation, December 15, 2008, through September 30, 2024.

$63.9 Million

*Please note: No administration costs, including the compensation of the SIPA Trustee and his counsel, are paid out of any recoveries obtained by the Trustee for the Customer Fund. 100 percent of the Customer Fund is for the benefit of BLMIS customers with allowed claims. Fees shown are those reported from the commencement of the liquidation on December 15, 2008 through September 30, 2024.